Condo Insurance in and around Minnetonka

Welcome, condo unitowners of Minnetonka

Cover your home, wisely

Home Is Where Your Heart Is

Life happens.. Whether damage from wind, fire, or other causes, State Farm has terrific options to help you protect your condo and personal property inside against unpredictable circumstances.

Welcome, condo unitowners of Minnetonka

Cover your home, wisely

Safeguard Your Greatest Asset

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with wonderful coverage that's right for you. State Farm agent John Erlandson can help you understand all the options, from liability, bundling to possible discounts.

If you want to learn more, State Farm agent John Erlandson is ready to help! Simply call or email John Erlandson today and say you are interested in this fantastic coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call John at (952) 999-4323 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

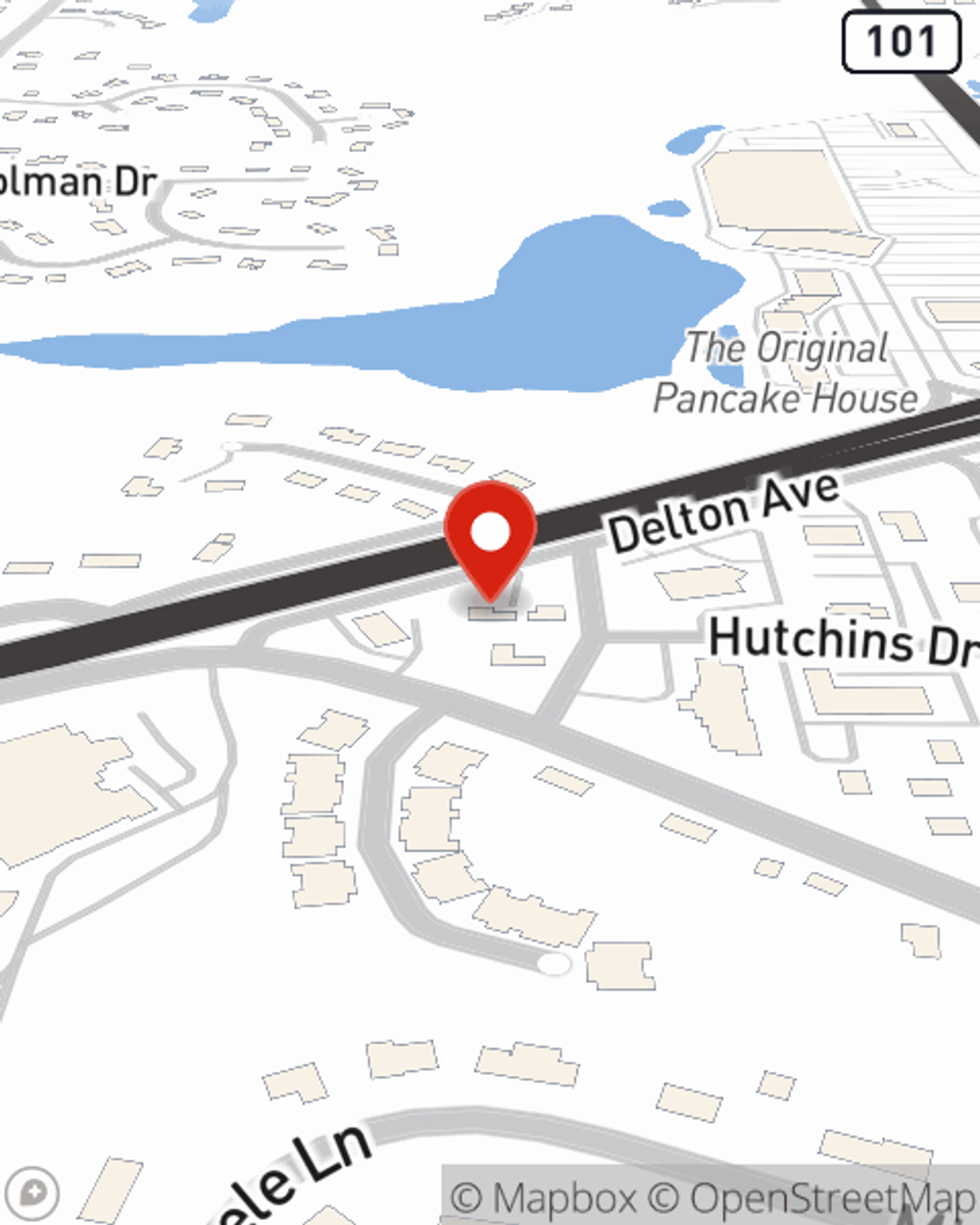

John Erlandson

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.